AI Investment BarChart: The Nations Racing Ahead in 2025

Key Players in the AI Investment BarChart

- Leader: Top investors with over $400B investment (e.g., USA)

- Runner-up: Countries with significant dominance (e.g., China)

- Major Player: Other top 5 nations (e.g., UK, Germany, Japan)

- Emerging Player: Fast-growing contributors (e.g., UAE)

- Minor Investor: Countries with small-scale investments

Visual Intelligence by FactsFigs.com

AI Investment Trends 2025

Data Source: Stanford AI Index Report 2025

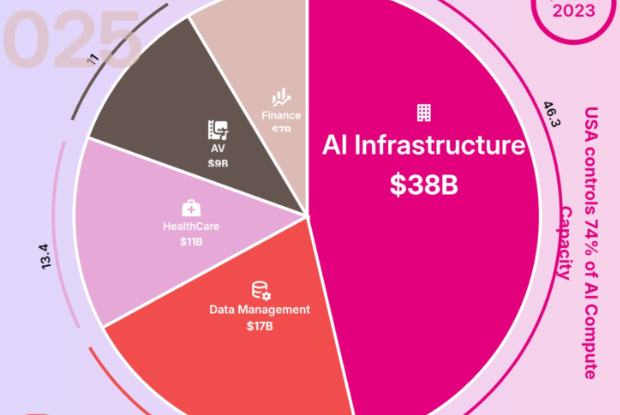

Overview

Artificial Intelligence (AI) has emerged as a pivotal sector, driving innovation and economic growth across the globe. Since 2013, private investments in AI have surged dramatically, reflecting its critical role in shaping the future of multiple industries. This rapid growth, however, has been characterized by varying levels of investment across different regions, with some leading the charge while others are quickly catching up.

The Global AI Race - Top 3 Nations

The race to dominate AI technologies has primarily been led by a few countries, each making significant strides in attracting private investments and fostering innovation in the sector. Let’s delve into the key dynamics of this race.

USA leads with $471B

The United States has consistently led the charge, amassing approximately $470 billion in private AI investments. This substantial figure highlights the country's commitment to remaining at the forefront of AI innovation and development. U.S.-based companies and research institutions have attracted the lion's share of these investments, driven by a robust ecosystem of startups, established tech giants, and a favorable regulatory environment.

China follows with $119B

In contrast, China has also emerged as a formidable contender in the global AI space. While its private investments, estimated at one-third of the U.S. total, may seem modest in comparison, China's strategy is heavily supported by strong government initiatives and policies aimed at fostering AI development.

UK invests $28B

The United Kingdom, though smaller in scale compared to the U.S. and China, has cultivated dynamic AI ecosystems characterized by innovation and collaboration. The U.K.'s AI investments are bolstered by a thriving research community, government-initiated AI strategies, and a spate of innovative startups making waves in fields like Healthcare Technology, Financial Services, and Autonomous Systems

Fast Facts: Other AI Players

- Canada $15B – A strong AI investor in North America.

- Israel $15B – A tech-forward nation investing heavily in AI.

- Germany $13B – Europe’s industrial leader expanding its AI footprint.

- India $11B – Rapidly growing AI investment landscape.

- France $11B – Strengthening its AI ecosystem within Europe.

- South Korea $9B – Driving innovation in AI and robotics.

- Singapore $7B – A tech hub with major focus on AI advancements.

- Sweden $7B – Among Europe’s key AI investors.

- Japan $6B – Maintaining AI investment momentum.

- Australia $4B – Building its AI infrastructure steadily.

- CH $4B – Investing in ethical and research-driven AI.

- UAE $4B – Leading AI efforts in the Middle East.

Projections for the AI Market Size Growth

Experts project that the AI market will continue to grow at an unprecedented rate, driven by innovations in deep learning, robotics, and AI-integrated solutions. By 2025, the market is expected to expand significantly, with private investments playing a critical role in fueling this growth.

Emerging Trends Leading to 2025

Several trends are likely to shape AI investments leading up to 2025, including advancements in autonomous vehicles, AI-driven healthcare solutions, and smart infrastructure. The demand for AI applications in enhancing operational efficiency and decision-making processes across industries is expected to surge.

AI’s Role in Reshaping Global Economic Structures

AI is set to play a crucial role in reshaping global economic structures, enhancing productivity, creating new market opportunities, and transforming workforce dynamics. Its integration into various sectors is anticipated to drive economic growth and innovation on a global scale.

Conclusion

As nations ramp up their investment in artificial intelligence, a clear hierarchy has emerged in the global race for technological dominance by 2025. Reports show that countries like the United States and China are leading the charge, with substantial financial commitments directed toward AI research and development. “Investing in AI is not just about technology; it’s about future economic strength,” stated Dr. Emily Chen, an expert in AI economics. Meanwhile, emerging players such as India and Brazil are also making significant strides, aiming to carve out their own niches in the market. As this competitive landscape evolves, it will be crucial for stakeholders to monitor trends and adapt strategies accordingly.

Data Source and Attribution

Source: Stanford AI Index Report 2025

The data presented in the visualization is derived from publicly available datasets, categorized into five tiers: Leader, Runner-up, Major Player, Emerging Player, and Minor Investor, based on the total volume of AI investments.

All investment values are represented in Billions of USD, rounded to the nearest whole number. Rankings are based on cumulative figures reported as of Q1 2025.

Last Verified: July 2025