The 'Fractional' Life: 2026

Tokenized Luxury & The End of Illiquidity

- Commercial R.E.: Stable, high-yield tokens representing ownership in skyscrapers.

- Fine Art: High-appreciation 'blue chip' art tokens (Warhol, Banksy).

- Vintage Cars: Passion assets that also serve as inflation hedges.

- IP Royalties: Music streaming rights providing monthly cash flow.

Visual Intelligence by FactsFigs.com

Boston Consulting Group (BCG)

Data Source: Boston Consulting Group

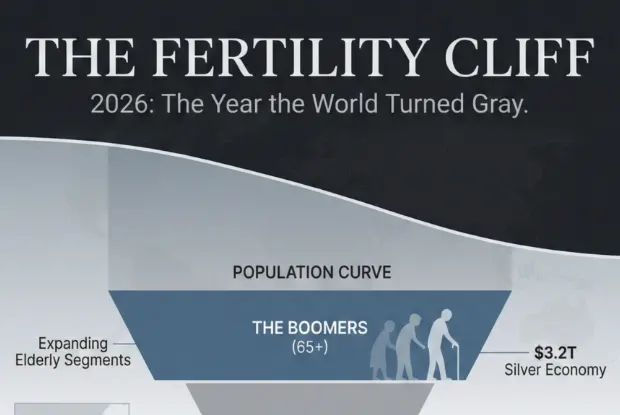

Overview

In 2026, the concept of 'ownership' has been redefined. The 'Fractional Life' is here. The $2.1 Trillion RWA (Real World Asset) Market has democratized wealth.

By splitting a $50 million building into 50 million tokens, assets that were once 'frozen' and 'exclusive' are now liquid and accessible. A 24-year-old can now hold a portfolio containing a Ferrari and a Manhattan penthouse, tradeable instantly.

Global RWA Market

The total value of 'Real World Assets' (RWA) live on blockchains by Q1 2026.

Fast Facts

- New Standard 60 % Percentage of Gen Z portfolios that hold at least one 'Fractional Alternative Asset' (vs. 5% for Boomers).

- Instant Liquidity $ 15 Billion The daily trading volume of tokenized assets, proving that 'illiquid' assets are now liquid.

- Stable Yield 6.5 % APY The average annual yield from rent distributed to token holders of prime NY real estate.

- Art Appreciation + 14.2 % The realized return on the fractionalized shares of Andy Warhol's 'Marilyn' series in 2025.

- Passive Income $ 45 / Mo The average monthly passive income generated by a $7,500 investment in music rights.

- Low Barrier $ 60 The average entry price to buy a 'share' of a blue-chip asset (down from $1M+).

The End of 'Illiquidity'

Historically, buying a building or a painting meant locking up cash for years. In 2026, Tokenization has solved this. With $15 Billion in daily volume, you can sell your 0.01% share of a Banksy painting as easily as selling a share of Apple stock. 'T+0' settlement means the cash hits your wallet instantly.

The Portfolio of the Future

The standard '60/40' portfolio is dead for Gen Z. It has been replaced by the 'Fractional Mix': 25% Commercial Real Estate (6.5% Yield), 20% Blue-Chip Art (14.2% Growth), and 10% IP Rights (Music Royalties). This diversification protects against inflation while offering the 'status' of owning trophy assets.

Access for Everyone

The barrier to entry has collapsed. The average minimum investment is now just $60. This isn't about buying a JPEG; it's about legal ownership of physical goods, enforced by smart contracts. The 'Velocity of Money' has increased, as capital can flow effortlessly between asset classes.

Conclusion

The 'Fractional Life' isn't just a financial trend; it's a social shift.

We are moving from an economy of 'Haves and Have Nots' to an economy of 'Shared Owners.'

Data Source and Attribution

Boston Consulting GroupSecurity Token MarketMasterworks

This analysis aggregates data from Boston Consulting Group's Tokenization report, the Security Token Market's 2026 industry state, and alternative asset performance indices.

Disclaimer: All calculated indices are based on internal FactsFigs methodologies and aggregated analysis. This content does not claim to represent an official global standard and is intended for educational purposes only.

Visual generated via FactsFigs AI Engine (v1.0).

2026-02-02