The Trillion Dollar Pivot - Climate Risk Financialization

Sovereign Green Bonds

Climate Risk Financialization (CRF) represents the systematic translation of previously unpriced environmental externalities into core financial variables.

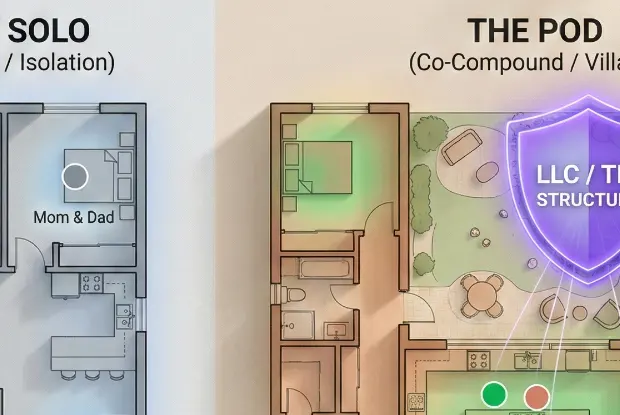

Focused on Transition Risk, Large-Scale Infrastructure. Projected growth by 2030 is 15%

Fast Facts - Other Climate Related Instrument Classes

- Valuation $ 200 B Primary Risk Mitigation Focus is Supply Chain Disruption, Risk Reduction. Projected to grow 25% by 2030

- Valuation $ 60 B Focused on Acute Climate Events, Physical Climate Risk Pricing. Growth 18% by 2030

- Valuation $ 15 B Primary Area of Focus is Regulatory Compliance, Emissions Trading. Projected growth is 35% by 2030

Climate Risk Financial Instruments

- Sovereign Green Bonds: Transition Risk, Large-Scale Infrastructure

- Climate Adaptation & Resilience Funds: Supply Chain Disruption, Risk Reduction

- Catastrophe Bonds: Acute Climate Events, Physical Climate Risk Pricing

- Carbon Credit Derivatives: Regulatory Compliance, Emissions Trading

Visual Intelligence by FactsFigs.com

Climate Adaptation Solutions Investment

Data Source: TCW

Overview

Climate Risk Financialization involves incorporating the physical and transition risks posed by climate change into financial frameworks, where they are considered tangible financial factors relevant to investment, lending, and risk management. This approach aims to redirect capital towards low-carbon initiatives, evaluate the susceptibility of assets, and safeguard financial systems against climate-related disruptions such as severe weather events or regulatory changes. It requires quantifying the effects on business profits, asset valuations, and national economies, prompting new regulations, enhanced disclosures like ESG reporting, and the creation of financial tools such as green bonds. This shift turns climate action into both a financial opportunity and a potential risk.

The Climate Risk Thesis

Climate Risk Financialization (CRF) is all about integrating environmental impacts, which were once overlooked, into key financial metrics. This shift isn't just about ethics or a nod to sustainable investing; it's a savvy move driven by the need to put a number on both sudden climate changes and ongoing environmental pressures.

Understanding Climate Risk

Climate risk refers to the potential financial losses and instability stemming from climate-related events and shifts. It encompasses two primary components: physical risks and transition risks. Physical risks arise from the direct impact of climate change, such as natural disasters, rising sea levels, and extreme weather events, which can disrupt operations and cause asset depreciation. For example, a significant flood can devastate supply chains, increase insurance costs, and damage infrastructure, leading to significant financial liabilities. Meanwhile, transition risks pertain to the financial impacts of the shift towards a low-carbon economy, including regulatory changes, technological evolution, and evolving market preferences. Companies reliant on fossil fuels may face increasing pressures to adjust their business models or risk facing regulatory penalties, showcasing how climate considerations are now indispensable factors in financial decision-making.

As awareness of climate risks grows, financial markets are witnessing transformative trends that are reshaping assessments and strategies. One notable trend is the increasing integration of environmental, social, and governance (ESG) criteria into investment portfolios. Investors are no longer assessing companies solely based on financial performance; rather, they are evaluating how well a company manages its climate impact, its sustainability practices, and its long-term viability in a changing environment. Additionally, tools like climate derivatives are emerging to help investors hedge against physical risks associated with climate change. For instance, companies can utilize weather derivatives to protect themselves against unforeseen weather events that could adversely impact their operations — underscore the financial community's proactive response to climate risks.

Another key trend influencing climate risk assessment is the growing demand for transparency in climate-related disclosures. Regulatory frameworks are evolving, and institutions are increasingly required to provide clearer insights into their climate risk exposure. For example, the Task Force on Climate-related Financial Disclosures (TCFD) has catalyzed organizations to disclose how climate risks could impact their businesses, promoting accountability and encouraging better strategies to mitigate risks. This push for transparency not only aids investors in making informed decisions but also drives corporations to adopt comprehensive climate risk assessment strategies, ultimately fostering a culture of sustainability within the financial sector. As these trends continue to gain momentum, the integration of climate risk assessment will likely become a cornerstone of financial planning and investment strategy.

Private Sector Investment Opportunity

The increasing need for climate resilience technologies is generating a $1 trillion opportunity for private capital by 2030. Although private sector investment has traditionally lagged, emerging market signals and a surge in climate-related disasters are transforming the landscape.

BankTrack

The world's largest banks hold over $1.6 trillion in credit exposures related to coal, oil and gas production, and fossil-fuel power

Financial Institutions

In an era where climate risk is an undeniable factor in financial decision-making, banks and investment firms are evolving their strategies to meet this new reality. Many institutions are now prioritizing sustainable finance as a core element of their operations, recognizing that failing to address climate concerns could jeopardize their profitability and long-term viability. For example, JPMorgan Chase has committed to facilitating $200 billion in sustainable financing by 2025, demonstrating a proactive approach to integrate environmental considerations into its lending and investment practices. This shift is not merely a trend; i's a strategic imperative that aligns financial growth with global sustainability goals.

Conclusion

In conclusion, the importance of climate risk assessment in finance cannot be overstated. As climate change continues to pose significant threats to our economy and environment, integrating climate risk into financial strategies is essential for the sustainability of both businesses and the broader financial system. By recognizing the implications of physical and transition risks, financial professionals can make informed decisions that align with both profit and planet, fostering a resilient economic landscape.

It is now more critical than ever for investors and financial institutions to adopt sustainable practices. This is a call to action to prioritize climate risk assessment and commit to innovative financial solutions that champion environmental stewardship. Together, we can turn the tide on climate challenges and shape a future that is not only profitable but also sustainable for generations to come.

Data Source and Attribution

The data presented in the visualization is derived from publicly available datasets, categorized into 4 Climate Risk Financial Instruments

All monetary values are expressed in billions of U.S. dollars unless stated otherwise and may be rounded to the nearest whole number. Rankings, where shown, are derived from internal calculation methodologies and do not claim authoritative or competitive standardization.

Last Verified: Jan 2026

Other Popular Topics

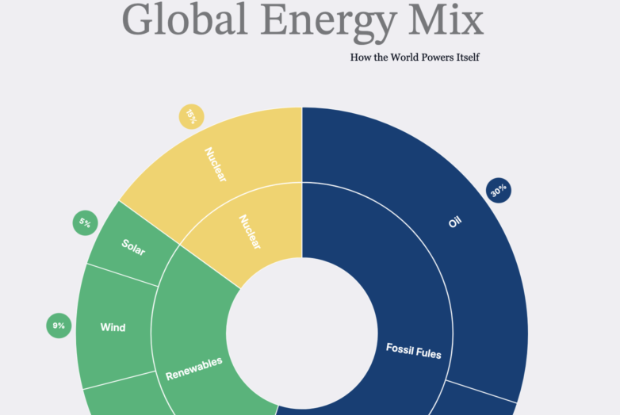

Understanding the Global Energy Consumption By Source

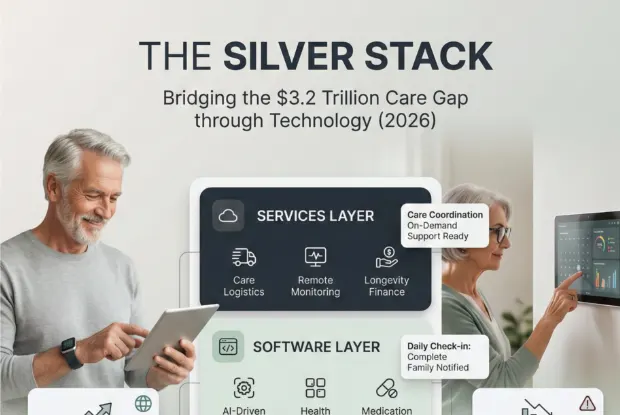

The Silver Stack: How AgeTech Became a $3.2 Trillion Necessity