Uncovering AI Investments of Last Decade

Top Growth Years

Years that saw the highest increase in investment.

Government regulations begin to shape the ecosystem.

AI models became multimodal and more capable.

Generative AI reached billions of users.

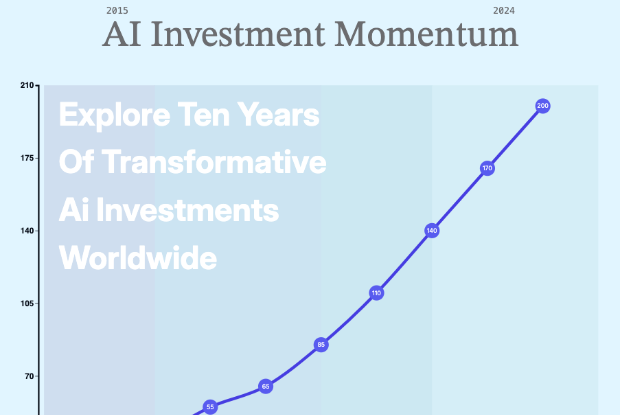

AI Investment Share per Year

- Year 2015 10 AI investments began to gain momentum globally.

- Year 2016 25 Increased funding from VCs and governments.

- Year 2017 40 Startups saw a surge in AI adoption.

- Year 2018 55 Breakthroughs in deep learning fueled growth.

- Year 2019 65 AI entered mainstream enterprise solutions.

- Year 2020 85 Pandemic accelerated AI use in healthcare and logistics.

- Year 2021 110 AI funding reached all-time highs.

Yearly breakdown of global private AI funding (2015–2024)

- Early Growth: Initial years with relatively low AI investments (2015–2016)

- Acceleration Phase: Years when investment growth started accelerating (2017–2019)

- Pandemic Spike: Surge in investment due to increased AI demand during the pandemic (2020–2021)

- Peak Innovation: Record-breaking investment levels reflecting global AI race (2022–2024)

Visual Intelligence by FactsFigs.com

Chart represents cumulative AI private investment by year

Data Source: Stanford AI Index 2025

AI Investment Growth 2015–2024

Over the past decade, global AI investment has shown exponential growth. The financial sector is undergoing a seismic shift, largely driven by the integration of artificial intelligence (AI). As algorithms become increasingly sophisticated, the landscape of investing is evolving, ushering in a new era where data-driven decisions are standard practice. AI is transforming how investors analyze opportunities and mitigate risks. This technological revolution not only optimizes existing strategies but also introduces innovative investment vehicles previously thought to be unattainable.

From $10B in 2015 to over $200B (per year) in 2024, the market has expanded rapidly due to advances in deep learning, data infrastructure, and enterprise adoption.At the heart of this transformation is the rise of AI private investments, a game-changer for both individual and institutional investors. As startups leverage AI insights to refine their pitches and secure funding, the implications stretch far beyond mere financial gains. These investments pave the way for a more transparent, efficient, and data-driven market, equipping investors with unparalleled access to crucial insights.

AI Expansion Accelerates

2020 marked a shift where AI moved from research labs to production environments, and funding reflected this shift.

Why It Matters

Tracking investment trends helps us understand where innovation is happening and which technologies are driving the next wave of growth.

Conclusion

The data highlights that AI is not just a trend — it’s a sustained technological revolution. In summarizing the transformative impact of AI private investments on the financial landscape, it is clear that these technologies are reshaping the way investors, startups, and financial professionals engage with the market. Enhanced data analysis and automated decision-making processes have not only increased efficiency and returns but also reduced human biases, offering a new paradigm in investment strategies. As we look to the future, the continual evolution of AI promises to unlock further opportunities, making it imperative for all stakeholders to adapt to this rapidly changing environment.

Data Reference & Sources

Data sourced from Stanford’s 2025 AI Index Report, which compiles global investment figures across private and public sectors.

Figures are inflation-adjusted and rounded for readability.

Annual investment values include funding from VCs, private equity, corporate investment, and M&A activities.

Verified on July 30, 2025

Other Popular Topics

Uncovering AI Investments of Last Decade

The Rise of Agentic AI: The 2026 Workforce Shift