Automated Care Decisions: How AI Is Reshaping Health Insurance

AI-Powered HealthCare Insurance - Efficiency Gains, Oversight Gaps

- Market Adoption: The rapid uptake of AI tools by insurers for operational tasks.

- Efficiency Gains: Areas where AI speeds up processing, such as instant approvals.

- Risk Factors: Concerns regarding denials, lack of oversight, and accuracy.

Visual Intelligence by FactsFigs.com

AI Adoption & Utilization Review Data (2024-2026)

Data Source: NAIC Survey 2024

Health Insurance Companies and Artificial Intelligence

Health insurance companies are in an 'AI arms race' to use Artificial Intelligence to decide if they should pay for your medical care. Insurers are deploying tools to streamline coverage decisions, while health care providers are adopting their own AI solutions to prevail in these review processes.

The AI Arms Race

Of 93 large insurers surveyed, 84% use AI for operations like fraud detection or utilization review.

AI Quicker Approvals vs Old System Denials - Fast Facts

- Gatekeeping 70 % 70% of large-employer market insurers use or explore AI specifically for prior authorization.

- The Green Lane > 93 % Medicare Advantage plans approve over 93% of requests, a volume well-suited for AI automation.

- Speed vs. Safety < 1 Min Insurers claim AI reduces review time from days to seconds, raising fears of rubber-stamping.

- Wrongful Denials 82 % Old and non-AI Algorithms made large scale errors in the past. High overturn rates on appeal (82% in one Medicare study) suggest many initial denials are incorrect.

- Trust Level Low Health Insurers - Least trusted sector in Health Care System. Use of AI in Health Insurance has sparked controversy.

Health Insurers Adoption Rate

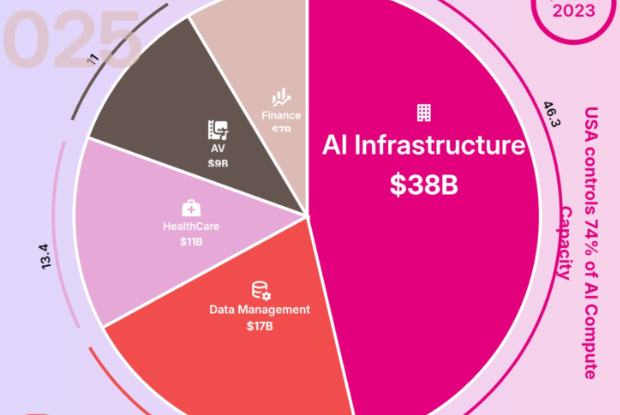

The uptake of AI by health insurers has been dramatic. A 2024 survey of 93 large health insurers revealed that 84 percent were using AI for operational purposes. A significant portion is dedicated to utilization management, with 70 percent of insurers in the large-employer market utilizing AI for prior authorization.

The Efficiency Promise

As Conversational AI for HealthCare matures, the Health Insurance Sector is findng that AI Automation is no longer an elective upgrade — it’s an operational necessity.. Medicare Advantage plans approve over 93% of prior authorization requests, making AI well-suited to automate these clear-cut approvals. For example, extracting patient information from EHRs (Electronic Health Record System) and quickly compare against medical approval criteria so that straight forward cases can immediately proceed with the process. This allows human reviewers to focus on complex cases. Additionally, provider-facing AI can extract clinical data to ensure submissions are complete, reducing technical denials.

The Risks: When AI Decides and Humans Just Approve

AI in Health Insurance loop is not without problems. Insurance companies say real doctors review every rejected claim, but in practice these reviews are sometimes done in less than a minute. That’s so fast it likely means people are just approving what the AI already decided, without really checking it.

On top of that, many staff members don’t have the training to catch when AI makes things up or gets facts wrong. And these prediction systems can also treat some groups unfairly, especially poorer or marginalized patients, because they don’t take real-life factors—like living conditions or access to care—into account.

Stronger Oversight of AI Health Insurers Is Needed

Strong oversight of AI in health insurance is clearly needed. Many hospitals don’t even test AI tools locally before using them, and more than a quarter of large insurers don’t properly track how accurate their AI models are or whether they are biased or getting worse over time. Around 40% don’t have clear accountability systems, such as review committees, to check how these tools affect claim approvals and denials. Some insurers are rolling out hundreds or even thousands of AI tools so fast that meaningful monitoring is unrealistic. While there are some federal and state rules, they don’t fully require insurers to prove these standards are actually being followed. As insurers move toward faster, more automated decisions, strong checks on AI use are not optional—they’re essential.

Conclusion

To ensure AI benefits the ecosystem rather than supercharging flawed processes, enhanced governance is required.

Regulators must demand transparency, robust monitoring, and true human review to prevent the 'Automated Gatekeeper' from becoming a barrier to care.

Data Source and Attribution

NAIC Survey 2024Stanford Health CareMedicare Advantage Reports

Data derived from the National Association of Insurance Commissioners 2024 Survey, Stanford Health Care AI Governance assessments, and analysis of Medicare Advantage prior authorization trends.

Disclaimer: Content based on provided policy insights regarding AI in health insurance.

2026-02-14