Ethereum in 2026: A Year In Review

The Road to Hegota & The Next Bull Run

- The Rally (2025): The post-Pectra surge in Q3 2025, driven by record ETF inflows and Smart Account adoption.

- The Correction (Current): The early 2026 market cooldown, testing the $2,000 support level amid macro headwinds.

- The Roadmap (Future): Upcoming upgrades (Glamsterdam & Hegota) focused on 10k TPS and statelessness.

Visual Intelligence by FactsFigs.com

Market Data & Roadmap Projections (Feb 2026)

Data Source: TradingView

Overview

In early 2026, Ethereum finds itself at a crossroads. After a landmark 2025 defined by the successful Pectra Upgrade and a Q3 institutional surge where ETH ETF inflows actually beat Bitcoin’s, the market has cooled.

As of February 2026, ETH is trading near $2,000, caught in a broader 'risk-off' environment. However, the fundamental roadmap remains aggressive. Developers are preparing for the Glamsterdam (H1 2026) and Hegota (H2 2026) upgrades, which promise to finally solve the network's 'state bloat' issue.

Tech vs. Price

In Q3 2025, Ethereum ETFs attracted $9 billion, temporarily outpacing Bitcoin ETFs.

Fast Facts

- Feb '26 Price $ 2000 ETH is currently holding delicate support at ~$2,000 after a 10% market-wide correction.

- ETF Assets + 28 % Spot ETH ETF assets grew 28% in late 2025, signaling renewed institutional interest.

- Max Stake 2048 ETH The 'Pectra' upgrade raised the validator stake cap, reducing network bloat.

- Throughput Goal 10000 TPS The 'Glamsterdam' upgrade aims to pave the way for parallel processing and higher TPS.

The 2025 Retrospective (Pectra & The ETF 'Flip')

2025 was the year Ethereum 'grew up' in the eyes of Wall Street. The 'Pectra' upgrade (May 2025) was a massive success, introducing Smart Accounts that allow wallets to pay gas in USDC. While Bitcoin ETFs dominated early 2025, Q3 saw a dramatic rotation: Ethereum ETFs pulled in $9 billion in a single quarter as institutions sought yield through staking.

The 2026 Roadmap (Glamsterdam & Hegota)

If 2025 was about usability, 2026 is about efficiency. The 'Glamsterdam' upgrade (H1 2026) aims to reduce centralized power and boost throughput towards 10,000 TPS. Later, 'Hegota' (H2 2026) will introduce Verkle Trees, allowing for 'stateless clients'—meaning you can verify the blockchain without downloading terabytes of data.

Price Action (The Bearish Start to 2026)

Despite the tech progress, price action remains tethered to macroeconomics. Following a market peak in October 2025, the crypto market has corrected. In Feb 2026, ETH sellers are tightening their grip, forcing the price to test the psychological $2,000 level. Technical indicators suggest caution in the short term.

Conclusion

Ethereum in 2026 is a story of 'Tech vs. Price.'

The network is technically stronger than ever, but the price is digesting the massive run-up of late 2025. The key to the next rally lies in the successful deployment of Glamsterdam.

Data Source and Attribution

TradingViewFinanceFeedsMitrade

Market data, on-chain metrics, and technical roadmap milestones are aggregated from TradingView, FinanceFeeds, and Mitrade analysis.

Disclaimer: This content is for educational and informational purposes only and does not constitute financial advice, investment recommendations, or an endorsement of any digital asset. Cryptocurrency markets are highly volatile; past performance is not indicative of future results. Please consult a qualified financial advisor before making investment decisions.

2026-02-10

Other Popular Topics

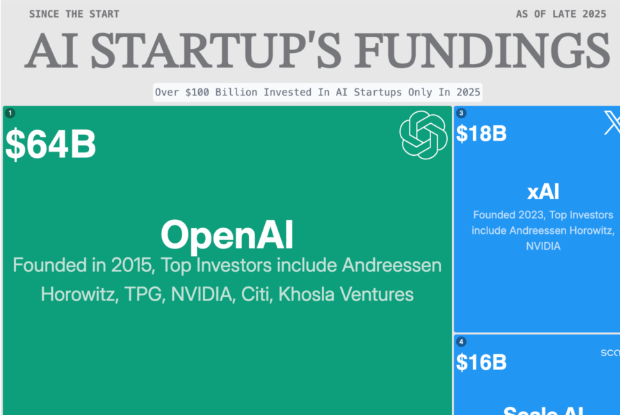

The Money Talk: Fundings of the Top 10 AI Startups

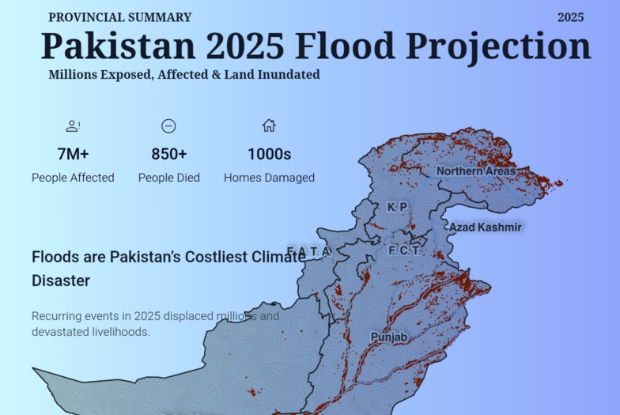

Flood Impact Across Pakistan 2025