The New Luxury: The Rise of the 'Offline Economy' in 2026

From FOMO to JOMO: The Market Shift to Analog Value

- Digital Decline: Metrics showing the saturation and rejection of hyper-connectivity.

- Analog Growth: Statistics related to physical media, nature tourism, and 'dumb' tech.

- Mental Wealth: Indicators of the psychological shift from FOMO to JOMO (Joy of Missing Out).

Visual Intelligence by FactsFigs.com

Global Wellness Institute

Data Source: Global Wellness Institute

Overview

In 2024, the ultimate status symbol was the latest smartphone. In 2026, the ultimate status symbol is the ability to leave it at home. We are witnessing the birth of the 'Offline Economy,' a market correction where value is migrating from digital connectivity to physical presence. This is not a rejection of technology, but a re-calibration—a shift from 'Always On' to 'Intentionally Off.'

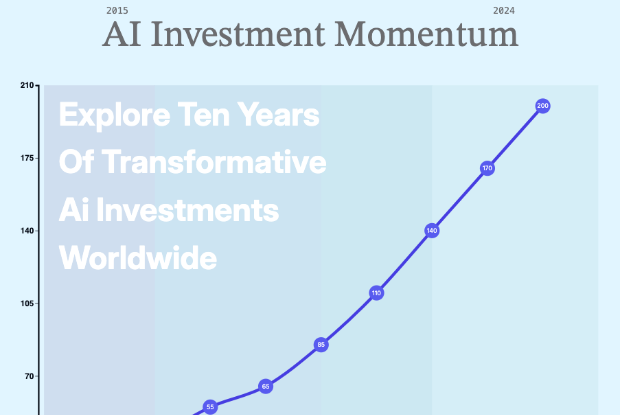

The drivers are clear: Digital Saturation and Algorithmic Fatigue. The average consumer is now exposed to 10,000+ ads per day. The human brain's response has been to disengage. We are seeing the first statistically significant drop in Daily Screen Time (-12%) among the 18-24 demographic. This cohort, previously the engine of the attention economy, is now actively buying 'Dumb Phones' (2.8M units) to reclaim their cognitive autonomy.

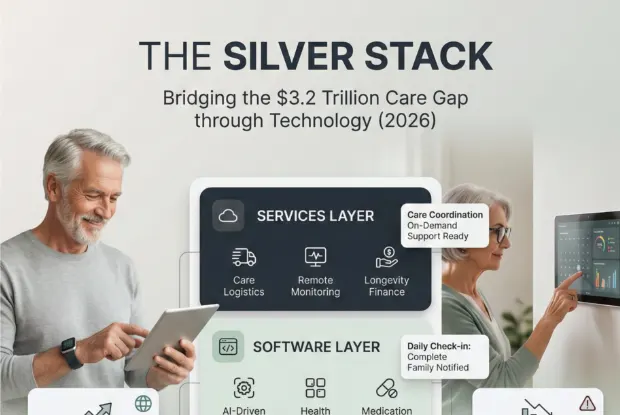

The immediate impact is a bifurcation of the luxury market. 'Connectivity' is becoming a utility for the working class, while 'Disconnection' is becoming a luxury product for the elite. The $42 Billion Silent Travel industry—resorts that lock your phone in a safe upon arrival—is proof that silence is the new gold.

For the first time in a decade, average daily social media usage has dropped among Gen Z, signaling 'Peak Screen.'

Fast Facts

- Luddite Tech 2.8 Million Global unit sales of feature phones (no apps/GPS) have hit a 5-year high, driven by the 'Luddite Club' movement.

- Digital Detox Tourism $ 42 Billion The 'Digital Detox' tourism sector has outpaced general travel growth, with premium 'Wi-Fi Free' resorts charging a premium.

- Improved Wellness 18 % Self-reported anxiety levels have decreased in cohorts that actively practice 'Tech-Free Sundays.'

- Tangible Culture 14 % Vinyl, cassette, and physical book sales are surging as consumers seek ownership over subscription fatigue.

- Attention Recession -8 % The 'Attention Recession' has lowered CPMs for mid-tier influencers as engagement shifts offline.

- Nature Boom 350 Million Park visitations and outdoor hobby participation have reached record highs in post-pandemic recovery.

The Macro View – Peak Screen

For two decades, the tech industry bet on infinite attention scaling. That bet has failed. We have hit 'Peak Screen.' The Creator Ad Rates (-8%) decline suggests that the efficiency of digital advertising is waning. The 'Attention Recession' means that simply putting content in front of a user is no longer enough; they are physically checking out. This has created a renaissance in Physical Media (+14%). Consumers, tired of 'renting' their culture through Spotify and Netflix subscriptions, are returning to vinyl and books. It is a quest for permanence in an ephemeral digital world.

The Data Deep Dive

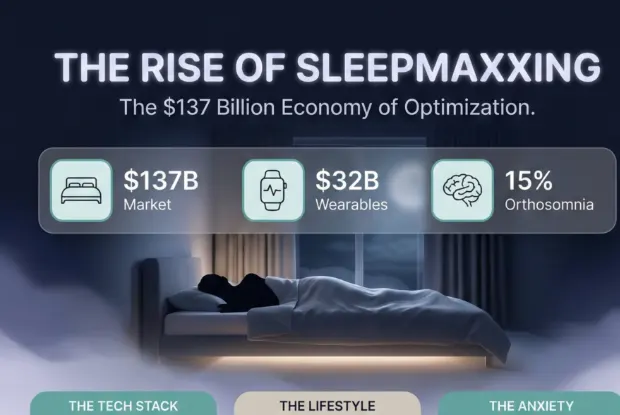

The most telling statistic is the Anxiety Index Drop (-18%) correlated with reduced connectivity. This 'Mental Wealth' metric is driving the Outdoor Recreation boom. With 350 million annual visitations to national parks, nature has become the antidote to the algorithm. This is not just a lifestyle trend; it is a public health movement. The 'Dumb Phone' phenomenon is particularly disruptive. By stripping away the browser and the camera, manufacturers like Light Phone and Nokia have created a new category of 'Zen Tech.' These devices are not cheap; they are priced as premium lifestyle tools, further cementing the idea that minimalism is a luxury.

Future Outlook – The Analog Premium

Looking ahead to 2027, we expect 'Offline Status' to become a core metric for HR and Wellness. Companies will begin offering 'Right to Disconnect' contracts as a hiring perk. The 'Offline Economy' will expand into education, where elite schools will market themselves on their 'Screen-Free' curriculums. The winners of this cycle will be the 'facilitators of presence'—hospitality, live events, and physical hobbies. The losers will be the 'aggregators of attention'—mid-tier social platforms and ad-supported games that rely on compulsive loops.

Conclusion

The 2026 'Offline Luxury' movement is the pendulum swinging back. After 20 years of rushing into the metaverse, humanity has decided that the physical universe is actually quite nice.

The smartest brands are no longer asking 'How do we get them to click?'; they are asking 'How do we get them to live?'

Data Source and Attribution

Global Wellness InstitutePew Research CenterNokia / HMD Global

This analysis aggregates data from the Global Wellness Institute regarding travel trends, Pew Research Center studies on digital usage patterns, and market sales reports from feature phone manufacturers like Nokia/HMD Global.

Disclaimer: All calculated indices are based on internal FactsFigs methodologies and aggregated analysis. This content does not claim to represent an official global standard and is intended for educational purposes only. It does not constitute financial or health advice.

Visual generated via FactsFigs AI (v1.0).

2026-02-02