The Silver Stack: How AgeTech Became a $3.2 Trillion Necessity

Bridging the $3.2 Trillion Care Gap through Technology (2026)

- The Demand Curve: Metrics showing the explosion of the 80+ demographic and care requirements.

- The Supply Flatline: Data on the critical shortage of human caregivers and the 'Care Gap.'

- The Silver Stack: The layers of technology (AI, Robotics, Fintech) filling the void.

Visual Intelligence by FactsFigs.com

World Health Organization / UBS

Data Source: World Health Organization

Overview

In 2026, the venture capital world has realized that 'Aging' is not a niche; it is the entire economy. The 'Silver Stack' has emerged—a suite of integrated technologies designed to manage the 'Demographic Winter.'

The driver is simple math: The number of adults aged 80+ is doubling, while the workforce available to care for them is shrinking. We are facing a global shortage of 10 million caregivers. The human infrastructure has collapsed; the digital infrastructure is being built to replace it. This has created a $3.2 Trillion market opportunity that spans robotics, AI monitoring, and longevity finance.

Silver Economy Valuation

The total market value of goods/services for the 60+ demographic in 2026, larger than the GDP of France.

Fast Facts

- The Care Cliff 10 Million The WHO projected deficit of health and care workers by 2030, creating a functional impossibility for human-only care.

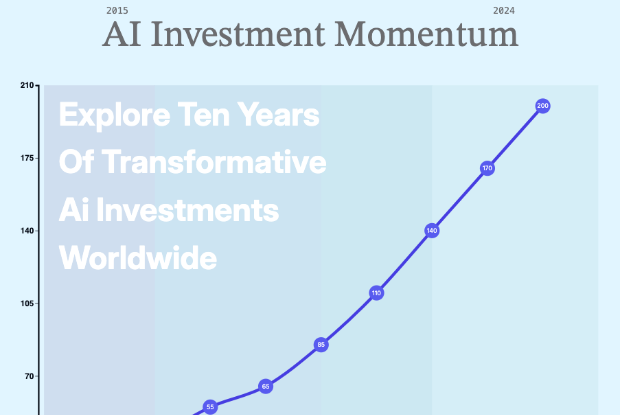

- Capital Inflow $ 700 Million Capital deployed into AgeTech startups in 2025/2026, signaling a shift from 'niche' to 'mass market'.

- High-Acuity Surge 2 x Speed The 80+ population is growing twice as fast as the 65+ demographic, driving demand for intensive care tech.

- Funding 100 Years 15 % Percentage of AgeTech funding going specifically to 'Longevity Finance' to help seniors manage decumulation.

- Digital Readiness 70 % Percentage of seniors comfortable using 'Health Wearables' or 'Remote Monitoring,' debunking the myth that elders reject tech.

- Immediate Shortfall 151000 Workers The immediate shortfall of paid care workers in the US alone by 2030, with rural areas hit hardest.

The Care Cliff – The Math Doesn't Work

The 'Care Gap' is the single biggest threat to GDP in the G7 nations. In the US, the deficit of 151,000 care workers means that 'Human-First' care is now a luxury product for the ultra-wealthy. For the remaining 99%, the only scalable solution is the 'Silver Stack'—automated systems that allow seniors to 'Age in Place' without 24/7 human supervision.

The Tech Stack – Robotics & AI

VC funding ($700M) has shifted from 'Big Buttons for Seniors' to 'Autonomous Care.' This includes Physical Layers (Lidar sensors detecting falls), Robotic Layers (retriever bots handling physical tasks), and Cognitive Layers (AI companions managing schedules and loneliness).

Longevity Finance – Funding the 100-Year Life

Living to 100 is expensive. A new wave of 'Longevity Fintech' startups is helping seniors unlock home equity and manage 'Decumulation' (spending down assets) effectively. This sector alone now commands 15% of all AgeTech funding, as traditional banks fail to serve the 'Super-Aged.'

Conclusion

The 'Silver Stack' is not about extending life; it is about sustaining quality of life when human labor is scarce.

In 2026, technology is the only caregiver that scales.

Data Source and Attribution

World Health OrganizationPitchBookThe Gerontechnologist

This analysis aggregates data from the World Health Organization's Global Health Workforce reports, UBS's Silver Economy outlook, and PitchBook's AgeTech venture capital trends for 2026.

Disclaimer: All calculated indices are based on internal FactsFigs methodologies and aggregated analysis. This content does not claim to represent an official global standard and is intended for educational purposes only.

Visual generated via FactsFigs AI Engine (v1.0).

2026-02-02