The 2026 Exchange Landscape

Giants, Specialists & Safe Havens

- The Global Titans (Tier 1): Exchanges with >$10B daily volume and massive global reserves.

- The Regulated Fortresses (Tier 2): Highly compliant, US-centric platforms focusing on security over leverage.

- The Altcoin Hunters (Tier 3): Platforms known for listing aggressive low-cap assets and high leverage.

Visual Intelligence by FactsFigs.com

Exchange Reserves & Asset Data (2026)

Data Source: Binance News

Overview

In 2026, the crypto exchange market has bifurcated into two distinct worlds: the 'Global Offshore' giants and the 'Onshore Regulated' fortresses. Binance remains the undisputed king of volume and reserves, holding over $155 billion in user assets.

However, Coinbase has cemented itself as the 'bank' of crypto, holding even more total assets ($206B) due to institutional custody. Meanwhile, platforms like Bybit and OKX have captured the sophisticated trader market, while Kraken continues to set the gold standard for security.

The Exchange Split

Dominates with ~30% of reserves in stablecoins, signaling high liquidity.

Fast Facts

- Coinbase Total Custody $ 206 B Remains the largest custodian by total assets, favored by US institutions.

- Kraken Hacks (Since 2011) 0 Maintains a flawless security record with zero client fund losses.

- Coins Listed 2000 + Leads in asset diversity, offering 8x more pairs than regulated exchanges.

- Bybit Daily Volume $ 3.5 B The third-largest exchange by volume, dominating the derivatives market.

The 'Big Three' (Volume & Liquidity)

Liquidity is king, and these three platforms rule the order books. Binance is the global leader, processing ~$18B daily despite regulatory headwinds. Bybit has become the derivatives powerhouse for leverage traders, while OKX serves as a vital bridge to Web3 markets, particularly in Asia.

The 'Safe Havens' (US & Compliance)

For users where safety > leverage. Coinbase is the 'Apple' of crypto—expensive (0.5% - 4% fees) but safe, with FDIC insurance on USD deposits. Kraken offers a flawless security record (0 hacks since 2011) and Proof of Reserves, making it a sanctuary for security-conscious traders.

The 'Altcoin Hunters' (High Risk, High Reward)

Where traders go to find the next 100x gem. MEXC and Gate.io are known for listing tokens fast, offering over 2,000+ coins compared to Coinbase's ~250. These platforms are favorites for 'degen' traders seeking volatility and low fees.

Conclusion

The 'best' exchange in 2026 depends entirely on your passport and your goals.

US citizens are effectively funnelled to Coinbase or Kraken for safety, while global traders seeking volume flock to Binance. The divide between 'regulated' and 'offshore' is wider than ever.

Data Source and Attribution

Data aggregated from Binance Reserve Reports, SWFI Asset Rankings, and TokenTax Exchange Reviews.

Disclaimer: This content is for educational purposes only. Cryptocurrency trading involves significant risk. FactsFigs.com does not endorse any specific exchange.

2026-02-10

Other Popular Topics

Justice Delayed: 1996–2026

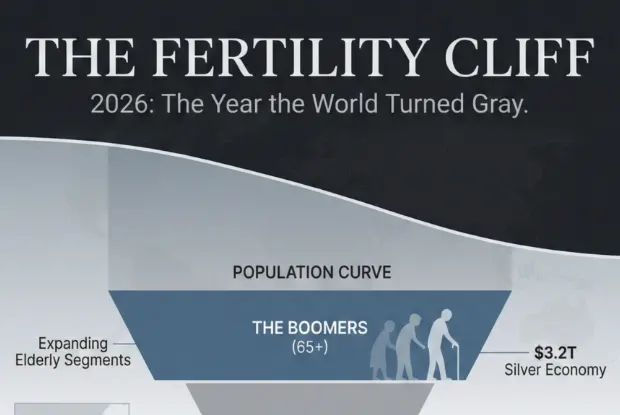

The Fertility Cliff: 2026's Demographic Winter