The Great Wealth Flip: 2026

$84 Trillion Changes Hands (and Form)

- Boomer Vault (Source): Traditional, slow-growth assets held by older generations.

- The Transfer Stream: The active flow of inheritance moving between generations.

- Heir Portfolio (Destination): High-risk, high-growth digital assets favored by Gen Z.

Visual Intelligence by FactsFigs.com

Cerulli Associates / Bank of America

Data Source: Cerulli Associates

Overview

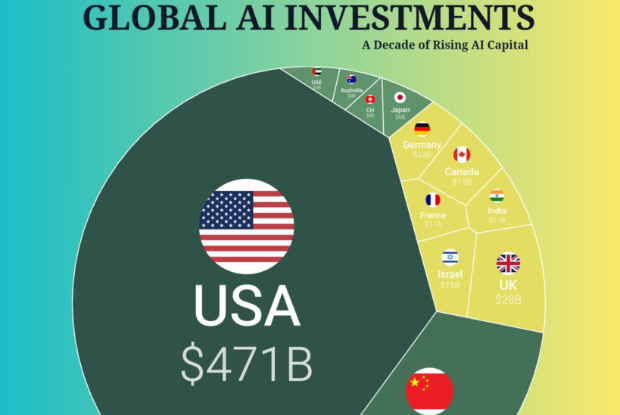

In 2026, the largest movement of capital in human history has hit warp speed. The $84 Trillion Great Wealth Transfer is underway. But as Boomers pass the baton, the heirs aren't keeping Dad's portfolio.

They are liquidating 'safe' assets and flooding into high-risk digital markets, fundamentally rewiring the global economy from centralized banks to decentralized networks.

Total Transfer Value

The estimated total value of assets set to pass from older to younger generations over the next two decades.

Fast Facts

- Peak Flow $ 2.5 Trillion The estimated amount of wealth changing hands in 2026 alone as the transfer accelerates.

- Digital Shift 45 % Surveys indicating the desired portfolio share Gen Z intends to move into digital assets upon inheriting.

- Preservation Mode 65 % Traditional portfolio weighting toward public equities and fixed income (Stocks/Bonds).

- The Great Dumping 82 % The percentage of heirs who fire their parents' traditional financial advisor post-inheritance.

- Risk Appetite 3 x Higher Comparative risk appetite of Gen Z investors versus Boomers, favoring volatility for higher returns.

- New Yield 8 % The projected slice of global wealth moving into Decentralized Finance protocols by late 2026.

The Boomer Vault – Solid & Slow

Boomers hold the majority of global wealth, locked primarily in traditional, illiquid assets: residential real estate, bonds, and blue-chip stocks. Their strategy was preservation via centralized institutions. This capital is heavy, slow-moving, and deeply entrenched in the 'Old Economy.'

The Heir Portfolio – Digital & Fast

Gen Z views traditional finance as slow and rigged. Upon inheriting, they pivot aggressively. The new allocation model favors Crypto (asymmetrical upside), Venture Capital (tech growth), and DeFi (yield without middlemen). Money is moving from managed funds to self-custody wallets.

The Advisor Crisis – The Great Dumping

The transfer is an existential crisis for Wall Street. Over 80% of heirs fire their parents' financial advisor upon receiving their inheritance. The traditional 'suit-and-tie' relationship doesn't translate to a generation that trusts community due diligence over fee-based management.

Conclusion

The Wealth Flip isn't just a transfer; it's a transmutation.

Old money is becoming new tech, shifting power from centralized banks to decentralized networks.

Data Source and Attribution

Cerulli AssociatesBank of AmericaCoinbase Institutional

This analysis aggregates data from Cerulli Associates' High-Net-Worth markets report, Bank of America's study on wealthy Americans, and Coinbase Institutional's 2026 wealth trends analysis.

Disclaimer: All calculated indices are based on internal FactsFigs methodologies and aggregated analysis. This content does not claim to represent an official global standard and is intended for educational purposes only.

Visual generated via FactsFigs AI Engine (v1.0).

2026-02-02