The 2026 Billionaire World Map

Where the World's Wealthiest Reside

- The Global Titans (Tier 1): Countries with >400 billionaires, dominating global wealth concentration.

- The Wealth Hubs (Tier 2): Nations with 100-300 billionaires, driven by industrial and resource wealth.

- The Emerging & Specialized (Tier 3): Financial centers and high-growth economies with <100 billionaires.

Visual Intelligence by FactsFigs.com

Global Billionaire Census Data (2026)

Data Source: UBS Reports

Overview

In 2026, the global map of extreme wealth remains heavily concentrated, yet dynamic. The United States maintains its overwhelming lead, home to 924 billionaires collectively worth nearly $7 trillion.

China follows as a distant second, while India has solidified its position in third place. The year has seen wealth creation accelerate, with total billionaire wealth hitting an all-time high of $18.3 trillion, driven by market surges and technological innovation.

The Geography of Wealth

The undisputed leader, holding nearly 32% of the world's billionaire population and $6.9T in wealth.

Fast Facts

- China 470 Remains the second-largest home to billionaires, driven by tech and manufacturing despite slower growth.

- India 205 A growing powerhouse ranking third globally, with wealth fueled by infrastructure and digital services.

- Germany 171 Europe's largest economy saw a 27% surge in billionaire count, driven by retail and industrial giants.

- Russia 140 Wealth remains heavily concentrated in energy and resources, showing resilience in billionaire numbers.

- United Kingdom 91 A key global financial hub that continues to attract foreign wealth despite economic headwinds.

- Switzerland 84 The world's banking vault punches above its weight with high wealth density per capita.

- Hong Kong 76 Remains a critical gateway to Asia, though growth has flattened compared to mainland peers.

- Italy 74 Wealth driven by luxury dynasties and manufacturing, with steady representation on the global list.

- Brazil 56 Latin America's giant leads the region, with wealth tied to banking, beer, and energy sectors.

The Global Titans (USA & China)

These two economic superpowers are in a league of their own. The United States accounts for nearly a third of the global total (924 billionaires) and sits far ahead of any other nation. China, ranking second with 470 billionaires, continues to mint wealth through technology and manufacturing, despite a moderation in its economic growth rate.

The Wealth Hubs (India, Germany, Russia)

This tier represents strong, established economies. India (205 billionaires) is the third-largest habitat for extreme wealth, fueled by infrastructure and digital services. Germany saw a massive 27% surge to 171 billionaires, driven by its industrial base. Russia remains resilient with 140 billionaires, largely derived from energy and commodities.

The Emerging & Specialized Economies

Beyond the top five, smaller economies are recording the fastest growth. Saudi Arabia saw its billionaire count skyrocket by 217%, and Singapore grew by 66%. Meanwhile, established financial centers like the UK (91), Switzerland (84), and Hong Kong (76) continue to punch above their weight as global safe havens for capital.

Conclusion

The 2026 map is a story of 'Old Money' vs. 'New Growth.'

The US and China dominate the volume, but the velocity of wealth creation is shifting toward emerging hubs like India and the Middle East.

Data Source and Attribution

Data aggregated from UBS Billionaire Ambitions Report 2025-26, and Forbes real-time wealth metrics.

Disclaimer: This content is for educational purposes only. Billionaire counts and wealth estimates are based on available public data and projections as of early 2026.

2026-02-11

Other Popular Topics

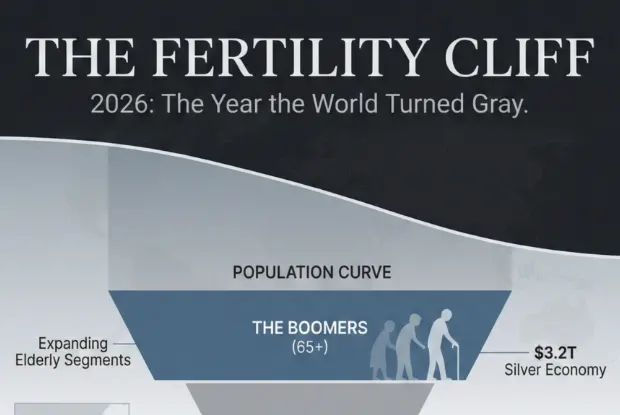

The Fertility Cliff: 2026's Demographic Winter

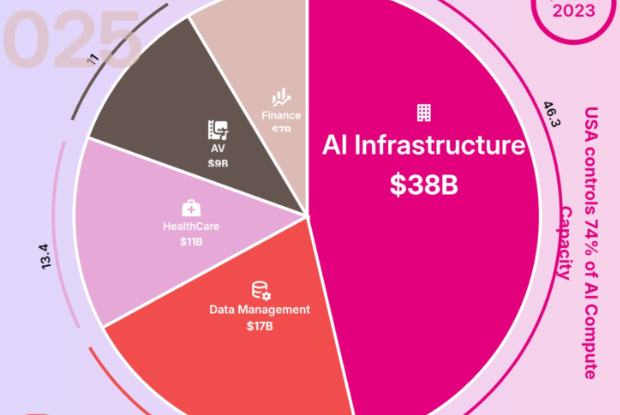

AI Investment 2025 - Top 5 Industries Set to Lead