The Great Decoupling: Central Bank Gold Reserves

Global Central Bank Gold Reserves (2020–2026)

- The East (Accumulators): Nations aggressively increasing gold allocation (China, India, Turkey, Poland). Driven by 'sanction-proofing' and diversifying away from the USD.

- The West (Stagnant): Nations with historically high but static gold reserves (USA, Germany, Italy). They treat gold as a legacy asset rather than a strategic hedge.

- The Asset Swap: The trend of selling US Treasury Bonds to purchase physical bullion.

Visual Intelligence by FactsFigs.com

World Gold Council / IMF / PBOC

Data Source: World Gold Council

Overview

In 2026, the global financial system is witnessing a 'Great Decoupling.' For decades, Central Banks held US Treasury bonds as their primary safety net. That era is over.

Driven by geopolitical fragmentation and the weaponization of financial rails, the Global South (led by the expanded BRICS+ bloc) is aggressively swapping paper debt for physical bullion. Gold is no longer just a store of value; it has become a geopolitical shield.

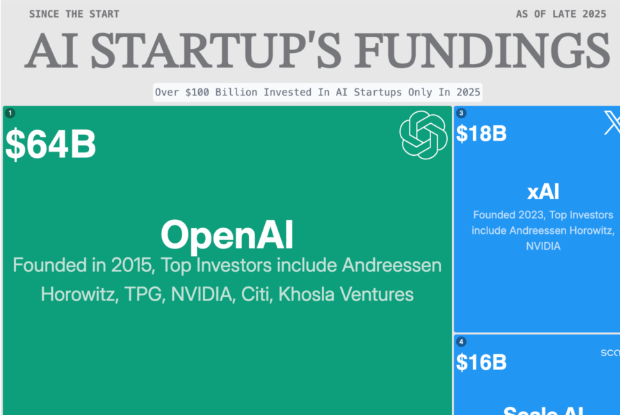

The Buying Spree

Estimated net purchases by global central banks in 2025, breaking previous records set in 2022 and 2024.

Fast Facts

- Consistency 42 Months The People's Bank of China (PBOC) has reported net gold inflows for 42 consecutive months as of early 2026.

- Threshold < 50 % For the first time, the US Dollar's share of allocated global foreign exchange reserves has dipped below the critical 50% psychological threshold.

- Leader + 300 Tonnes China remains the volume leader, effectively swapping its trade surplus into hard assets rather than foreign debt.

- The Shift 1: 1.8 For every $1 billion in US Treasuries sold by BRICS nations in 2025, approximately $1.8 billion was re-allocated into physical commodities.

The Sanction-Proof Shield (Why They Buy)

The catalyst was not inflation; it was geopolitics. The freezing of Russian forex reserves in 2022 sent a shockwave through the Global South. The message was clear: 'If your savings are in dollars, they can be turned off.' In reaction, nations like China, India, and Saudi Arabia realized that sovereign debt involves counterparty risk. Gold does not. By repatriating physical gold, these nations are building a financial stack that cannot be frozen by foreign legislation.

The Volume Shift (East vs. West)

The gold market has bifurcated. The G7 nations (USA, Germany, France) already hold 60-70% of their reserves in gold and their activity is dormant. In contrast, the buying pressure is entirely Eastern. Countries like Poland and Singapore have joined the rush, viewing gold as the only neutral asset in a polarized world. In 2025 alone, the 'Global South' accounted for 92% of all net Central Bank purchases.

The De-Dollarization Metric

The data shows a direct inverse correlation: as holdings of US Treasuries by foreign central banks hit a 15-year low relative to total reserves, gold holdings rise. The 'recycling' of trade surpluses—formerly automatic purchases of US debt—has stopped. The new surplus recycler is gold. This structural shift has created a permanent 'price floor' for the metal, decoupled from traditional interest rate logic.

Conclusion

The 'Great Decoupling' is not about the immediate end of the dollar as a currency; it is about the end of the dollar as the *exclusive* store of sovereign trust.

In 2026, Central Banks have voted with their vaults: Trust in paper is declining; trust in physics is rising.

Data Source and Attribution

World Gold CouncilIMF DataPBOC

This analysis aggregates data from the World Gold Council's 'Gold Demand Trends 2025', IMF COFER reports (2026), and official monthly updates from the People's Bank of China (PBOC).

Disclaimer: This content analyzes macroeconomic trends and central bank data. It does not constitute financial investment advice.

Visual generated via FactsFigs AI Engine (v1.0).

2026-02-06

Other Popular Topics

The 'Fractional' Life: 2026

The 'Vibe Coding' Revolution: How Natural Language Became the New Syntax