The Co-Compound: From Isolation to Village

The End of the Nuclear Family (From Isolation to Village)

- The Solo (Nuclear): The traditional 'Mom, Dad, Kids' unit. Characterized by high mortgage stress, isolation, and rigid zoning reliance.

- The Pod (Co-Owners): The new unit: 3-5 non-romantic adults (friends/siblings) pooling capital. Characterized by shared equity and communal living.

- The Shield (Legal Ops): The infrastructure making it possible: LLCs, 'Property Prenups,' and operating agreements that manage chores and exits.

Visual Intelligence by FactsFigs.com

Fox Business / National MI / Pacaso

Data Source: Fox Business

Overview

The 'White Picket Fence' dream hasn't died; it has just been crowdsourced. In 2026, the 'Nuclear Family' model is being rapidly displaced by 'The Co-Compound.'

Driven by the twin crises of affordability and loneliness, friends and siblings are forming legal unions to buy mansions they couldn't afford alone. This is not 'roommates' renting a flat; this is 'co-equity'—a sophisticated financial merger of social circles.

Gen Z Adoption

The percentage of Gen Z adults open to co-buying a home with a friend to bypass market barriers.

Fast Facts

- Growth + 22 % Sibling co-ownership jumped from just 4% in 2023 to 22% in 2025, becoming a dominant entry point.

- Leverage 4.7 x The increased loan qualification power of a 4-person 'Pod' compared to a dual-income couple.

- The Gap 94 % Co-owners who report needing professional help drafting 'exit strategies' to prevent relationship collapse.

- Volume 15 % Americans who have already co-purchased a home with a non-romantic partner (friend or relative) as of late 2025.

The Economic Necessity (The Mansion Math)

The math of 2026 is simple: A couple cannot buy a starter home, but four friends can buy a luxury estate. By pooling four incomes, groups are bypassing the competitive 'starter home' market entirely and bidding on larger, premium properties that sit stagnant on the market. The fastest-growing demographic is siblings. Instead of waiting for inheritance, brothers and sisters are merging savings to secure family assets now, turning homeownership into a multi-generational team sport.

The Social Antidote (Intentional Community)

The Co-Compound is solving the 'Loneliness Epidemic' by structural design. Residents cite 'baked-in community' as a primary driver. The shared kitchen is no longer a source of tension but a social hub. These arrangements often mirror family structures without the biological imperative. Care for pets, maintenance, and even emotional support is distributed across the group, reducing the burnout common in dual-income nuclear households.

The Legal Framework (LLCs & TICs)

The biggest shift in 2026 is the professionalization of friendship. You don't buy a house with a handshake. Successful compounds run on Tenancy in Common (TIC) deeds or LLCs. These legal structures define exactly what happens if one person gets married, wants to sell, or loses their job. The 'Shotgun Clause' has become standard dinner table talk—agreeing on buyout prices before the furniture is moved in. The romanticism of living with best friends is sustained only by the cold hard logic of contract law.

Conclusion

The Co-Compound represents a return to village-style living, updated for the asset economy.

It proves that in a high-cost future, 'Family' is no longer just who you are related to; it is who you are incorporated with.

Data Source and Attribution

This analysis aggregates data from JW Surety Bonds & Fox Business reporting on non-romantic co-ownership (2025), National MI / FirstHome IQ's 'Gen Z Co-Buying Trends Report 2025,' and Pacaso's guides on Tenancy in Common and Real Estate LLCs.

Disclaimer: This content analyzes emerging housing trends and legal structures. It does not constitute financial or legal advice.

Visual generated via FactsFigs AI Engine (v1.0).

2026-02-05

Other Popular Topics

The Rise of Agentic AI: The 2026 Workforce Shift

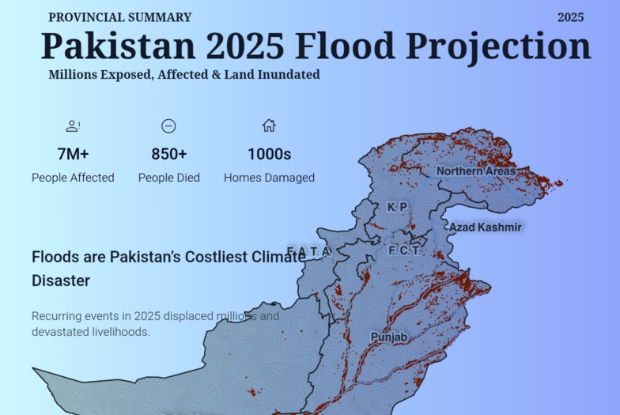

Flood Impact Across Pakistan 2025