The Connector Economies: US - Middleman - China

Who Wins the US-China Trade War?

- The Source (China): The origin of intermediate goods, facing direct export friction with the West due to tariffs.

- The Connectors (Bridges): Nations (Mexico, Vietnam, Poland) with free-trade access to the West and capacity to process Chinese inputs.

- The Destination (US/EU): The final consumer markets seeking to 'de-risk' while maintaining access to affordable goods.

Visual Intelligence by FactsFigs.com

Global Trade Flows & FDI Data

Data Source: UNCTAD

Overview

As direct trade between the US and China cools due to tariffs and 'de-risking' policies, a new class of winners has emerged. These are 'The Connector Economies'—nations like Mexico, Vietnam, Poland, and Morocco.

By importing components from China and exporting finished goods to the West, they are profiting directly from geopolitical fragmentation, proving that in a fractured world, the middleman is king.

The Middleman Strategy

Imagine two giant shops—the US and China—stop selling things directly to each other because they are arguing. Instead of stopping trade, they start using a friend to pass items back and forth. That 'friend' is a country like Mexico or Vietnam.

Mexico surpassed China as the top trading partner to the United States for the first time in over two decades.

Key Takeaways

- Investment + 45 % Foreign Direct Investment into top 'Connector Economies' has surged as factories relocate.

- Detour Value $ 150 B+ The estimated annual value of goods rerouted through connectors to bypass tariffs.

- US Imports 20 % Vietnam's share of US imports in key sectors like electronics and textiles has tripled.

- Growth 3 x Container throughput at Morocco's Tangier Med is growing at 3x the rate of traditional hubs.

The Great Rerouting

The logic of 'efficiency' has been replaced by the logic of 'resilience.' Since 2018, rising US tariffs on Chinese goods created an immense financial incentive to find a 'back door.' Western corporations are now under pressure to reduce reliance on China, morphing the 'China + 1' strategy into a 'China + Many' reality.

The 'Triangle Trade' Mechanism

The supply chain hasn't decoupled; it has just added a stop. Chinese companies are moving production *to* the Connector economies. Components are shipped from China to countries like Vietnam or Mexico, assembled there to change their 'country of origin,' and then exported to the US or EU tariff-free.

The New Winners

Geographic luck meets industrial policy. Mexico is the ultimate beneficiary, surpassing China as the top US trade partner thanks to the USMCA. Vietnam has captured low-to-mid-end manufacturing, while nations like Morocco and Poland serve as key industrial bridges for the European market.

Conclusion

The world isn’t decoupling. It’s adding middlemen.

The US and China didn't stop trading. They just started trading through friends—and those friends are the new winners.

Data Source and Attribution

UNCTADU.S. Census BureauWorld Bank

Data aggregated from the UNCTAD World Investment Report 2025, U.S. Census Bureau Foreign Trade Statistics, and The World Bank Logistics Performance Index.

Disclaimer: This content analyzes global trade flows and economic trends for educational purposes.

2026-02-06

Other Popular Topics

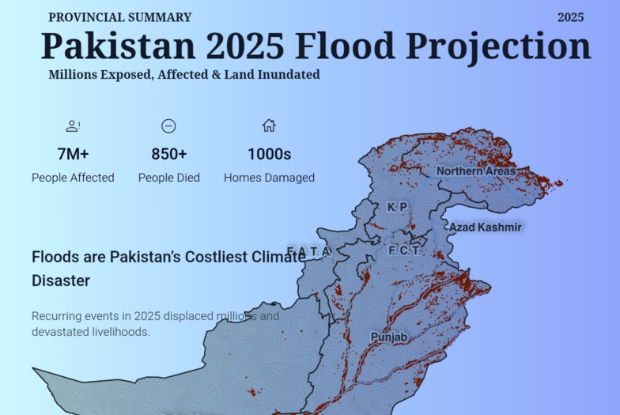

Flood Impact Across Pakistan 2025

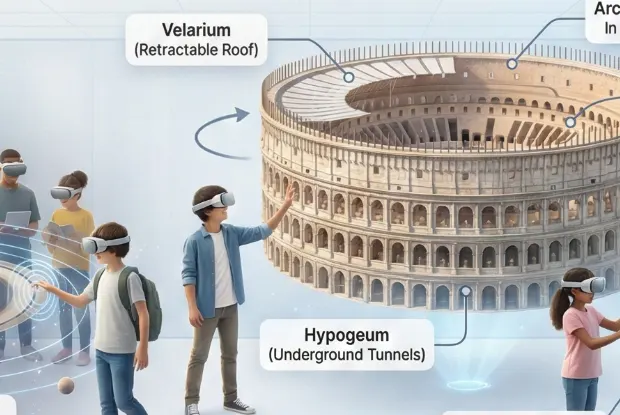

Spatial Schooling: The Death of the Textbook